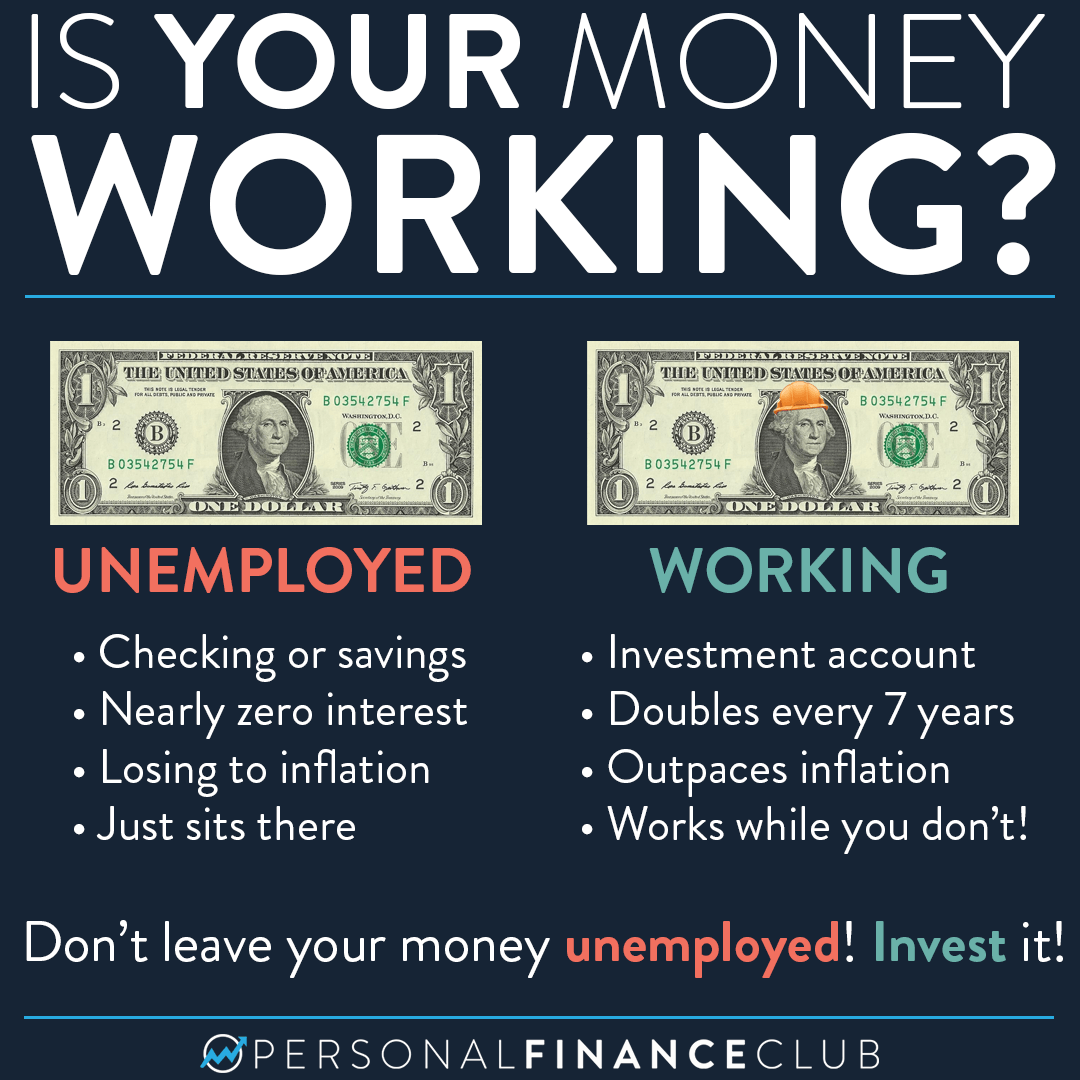

Invest in assets that generate passive income, like stocks or real estate. Create a budget to save and invest wisely.

Making your money work for you involves strategic financial decisions and disciplined investment. Start by creating a comprehensive budget to track your income and expenses. Allocate a portion of your earnings to savings and investment accounts. Invest in diversified assets such as stocks, bonds, or real estate that offer passive income opportunities.

Consistent contributions to retirement accounts can also build wealth over time. Educate yourself on financial literacy to make informed decisions. Automate your savings and investments to stay consistent. With time and patience, these strategies will help grow your wealth and secure financial stability.

Introduction To Financial Empowerment

Table of Contents

Financial literacy is very important. It helps you make smart money choices. Understanding money can change your life. You can avoid debt and save more. This knowledge gives you power. You become confident in managing your money.

Financial literacy means knowing how money works. It includes saving, investing, and budgeting. Knowing these can help you reach your goals. You will feel secure. You can make better decisions. It helps you plan for the future.

Setting goals is the first step. Decide what you want to achieve. Goals can be short-term or long-term. Save for a vacation or retirement. Write down your goals. This makes them real. Track your progress. Adjust as needed. This keeps you on track.

Credit: www.amazon.com

Budgeting Basics

Master the basics of budgeting to make your money work for you. Create a plan, track expenses, and prioritize savings. Achieve financial goals with disciplined spending and smart investments.

Creating A Budget

A budget helps you control your money. Start by listing all your income and expenses. Income is the money you get. Expenses are the money you spend. Make sure your expenses are less than your income. Try to save some money each month. This will help you in emergencies.

Tracking Expenses

Track your expenses to see where your money goes. Write down every purchase. Use a notebook or an app. Check your expenses weekly. This helps you understand your spending habits. Find areas where you can cut costs. Saving small amounts can add up over time.

Building An Emergency Fund

An emergency fund is very important. It helps you during tough times. Unexpected expenses can come up anytime. You might face medical bills or car repairs. Without an emergency fund, you may need to borrow money. This can lead to more debt. Having savings gives you peace of mind. It makes you feel secure and prepared.

Start small to build your emergency fund. Save a little bit from each paycheck. Set a goal for your savings. Aim to save at least three to six months of expenses. Automate your savings if possible. This way, you save without thinking. Cut unnecessary expenses to boost your savings. Every little bit helps. Track your progress and celebrate small wins. Stay committed to your goal.

Investing For Beginners

Stocks let you own part of a company. Bonds are loans you give to companies or the government. Mutual funds pool money to buy many stocks or bonds. Real estate means buying property like houses or land. Each type of investment has its own risks and rewards.

Stocks can make a lot of money but can also lose money fast. Bonds are safer but earn less. Mutual funds spread risk but charge fees. Real estate can grow in value but needs care and money.

Maximizing Retirement Savings

401(k) plans are a great way to save for retirement. Many employers offer these plans. You can contribute a portion of your paycheck. Some employers match your contributions. This is free money for your retirement. The money grows tax-free until you withdraw it. Start contributing as early as possible. The earlier you start, the more your money grows. Even small contributions add up over time. Check if your employer offers a match. Always try to contribute enough to get the full match.

IRAs offer another way to save for retirement. You can open an IRA at many banks or financial institutions. There are two types: Traditional and Roth. Contributions to Traditional IRAs may be tax-deductible. Roth IRAs offer tax-free withdrawals in retirement. The choice depends on your current tax situation. Try to contribute the maximum allowed each year. This helps your money grow faster. The money in IRAs grows tax-free. This means more money for your retirement.

Credit: www.personalfinanceclub.com

Generating Passive Income

Real estate is a strong way to grow wealth. Buying rental properties can bring in monthly income. Tenants pay rent, which becomes your passive income. Property values often go up over time. This can add to your earnings. Real estate investment trusts (REITs) are another option. They let you invest in property without owning it. Dividends from REITs can be a steady income source.

Dividend stocks pay you a share of the company’s profit. This is usually every three months. Investing in these stocks can provide regular income. Companies like Coca-Cola and Procter & Gamble are known for paying dividends. Reinvesting these dividends buys more shares. This can grow your investment over time. Blue-chip stocks are often stable and reliable for dividends.

Reducing Debt

Focus on paying off high-interest debt first. This can save you money in the long run. Use the snowball method to pay off small debts first. This helps build momentum. The avalanche method targets high-interest debts. This can reduce the total interest paid.

Consider a debt consolidation loan. This combines multiple debts into one. It often has a lower interest rate. A balance transfer credit card can also help. Transfer your debt to a card with a 0% introductory rate. This saves money on interest for a set period.

Credit: www.amazon.com

Seeking Professional Advice

Consulting a financial advisor can help optimize your savings and investments. Expert guidance ensures your money grows efficiently. Transform financial goals into reality with professional advice.

Financial Advisors

Financial advisors can help you manage your money. They provide guidance on investments and savings. Advisors can also plan for your retirement. They charge fees for their services. Make sure to choose a certified advisor. Check their credentials and reviews online. A good advisor can help you grow your wealth. They offer personalized financial plans.

Robo-advisors

Robo-advisors use technology to manage your money. They are cheaper than human advisors. Robo-advisors create portfolios based on your goals. They use algorithms to invest your money. These platforms are easy to use. You can start with a small amount of money. Robo-advisors are good for beginners. They offer automatic rebalancing and tax-loss harvesting. This makes investing simple and efficient.

Maintaining Financial Discipline

Regular check-ups help keep your finances in order. Track your expenses and compare them to your budget. Identify areas where you spend too much. Make adjustments to save more money. Review your investments often. Ensure they align with your financial goals. Check your credit report for errors. Correct any mistakes you find. A healthy financial routine helps you stay on track. Small changes can lead to big savings. Stay focused and disciplined. Your future self will thank you.

Stay informed about financial news. Read articles and watch videos on personal finance. Learn new strategies for saving and investing. Follow experts who give good advice. Understand market trends and their impact. This helps you make better financial decisions. Join forums and discussions to share ideas. Ask questions when confused. Knowledge is power. Stay updated to make your money work better for you.

Frequently Asked Questions

What Does It Mean To Make Your Money Work For You?

Making your money work for you means using it to generate more wealth. This can be done through investments, savings, or starting a business.

How Can I Start Investing My Money?

You can start investing by opening a brokerage account. Research different investment options like stocks, bonds, and mutual funds.

What Are The Best Ways To Save Money?

The best ways to save money include budgeting, reducing unnecessary expenses, and automating your savings. High-yield savings accounts are also beneficial.

Why Is Passive Income Important?

Passive income is important because it provides financial stability without continuous active work. Examples include rental income, dividends, and royalties.

Conclusion

Making your money work for you is essential for financial growth. Start by setting clear financial goals. Invest wisely and diversify your portfolio. Monitor your progress regularly and adjust strategies as needed. By following these steps, you can achieve financial security and enjoy a prosperous future.